Curriculum

Options - Art of Spreads

Welcome and Introduction

0/1Vertical Spreads

0/3Debit Spreads

0/4Credit Spreads

0/7Bonus Material

0/2Iron Condor Basics

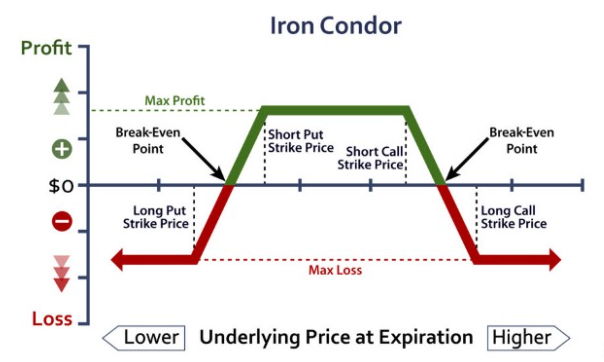

An iron condor is an option strategy which combines two credit spreads. It’s not complicated but managing the position might be time consuming and risky. .

· A Bear call credit spread is implemented above the present stock price. A Bull put credit spread is implemented below stock price. The main goal of any credit spread is to take advantage of the short options’ time decay while protecting the position with further OTM out-of-the-money long options.

– Many option traders who trade iron condors will base the credit spreads off potential support and resistance levels. — – Some may use a specific delta et al. may choose another sort of technical analysis to base the spreads off. The trade is predicated on the likelihood of the stock trading between both credit spreads by expiration.

Example:

· When Netflix Inc. (NFLX) was trading around $488, the stock had some potential resistance at about $500 and a few potential support near $475, as seen on the 15-minute chart.

· A bear call credit spread with the short strike out in 500 or higher would expire worthless if the stock stayed below $500 at expiration. A brief strike put at 475 or lower would expire worthless if the stock stayed at $475 or higher at expiration.

Both short options would wish to be protected by further out-of-the-money long options. Both spreads would expire worthless and both premiums are the traders to stay if NFLX closes at or between the short strikes. the whole risk on the trade is additionally reduced due to both premiums received.

· During this particular example,

· the 500/505 call (buy high strike price & sell low strike price ) spread was sold and the 470/475 put spread (buy low strike price & sell high price ) was sold for a total credit of 1.10 ((7.85 – 6.80) + (6.95 – 5.90)) as seen below. The $1.10 (or $110 in real terms) is that the max profit potential. Max risk is that the difference between the strikes minus the whole credit. during this case, max risk is 3.90 (5 – 1.10).

· Max profit is achieved if all the choices expire worthless at expiration (at or between $475 and $500)

. Maximum loss would occur if the stock is at or below $470 or at or above $505 at expiration. Regardless of what happens, one among the credit spreads will always expire worthless. This needless to say doesn’t guarantee a profit though.

Summary

· Iron condors is an excellent strategy to cash in of time decay (positive theta) when the stock is going to be trading in a range for a specific amount of time . The main key is to set your target profit and target loss parameters before entering the trade. And manage the trade as per the risk management plan.

That’s all. Trade safe..!!