Curriculum

Options - Advanced Concepts

Calendars

0/13-

Calendar Spreads1 min

-

Front Month vs Back Month Decay2 min

-

Best conditions for calendar spread2 minPreview

-

Trade Entry2 min

-

ATM calendar1 min

-

Calendar with Long Delta2 min

-

Split Strike Calendar in High vix5 minPreview

-

Execution2 min

-

Calendar Adjustments5 min

-

Lower Adjustment Point - Long PUT5 min

-

Upside Adjustment - Make it Double Calendar2 min

-

More Adjustments2 min

-

EXIT2 min

Calendars

0/13-

Calendar Spreads1 min

-

Front Month vs Back Month Decay2 min

-

Best conditions for calendar spread2 minPreview

-

Trade Entry2 min

-

ATM calendar1 min

-

Calendar with Long Delta2 min

-

Split Strike Calendar in High vix5 minPreview

-

Execution2 min

-

Calendar Adjustments5 min

-

Lower Adjustment Point - Long PUT5 min

-

Upside Adjustment - Make it Double Calendar2 min

-

More Adjustments2 min

-

EXIT2 min

Calendars

0/13-

Calendar Spreads1 min

-

Front Month vs Back Month Decay2 min

-

Best conditions for calendar spread2 minPreview

-

Trade Entry2 min

-

ATM calendar1 min

-

Calendar with Long Delta2 min

-

Split Strike Calendar in High vix5 minPreview

-

Execution2 min

-

Calendar Adjustments5 min

-

Lower Adjustment Point - Long PUT5 min

-

Upside Adjustment - Make it Double Calendar2 min

-

More Adjustments2 min

-

EXIT2 min

Calendars

0/13-

Calendar Spreads1 min

-

Front Month vs Back Month Decay2 min

-

Best conditions for calendar spread2 minPreview

-

Trade Entry2 min

-

ATM calendar1 min

-

Calendar with Long Delta2 min

-

Split Strike Calendar in High vix5 minPreview

-

Execution2 min

-

Calendar Adjustments5 min

-

Lower Adjustment Point - Long PUT5 min

-

Upside Adjustment - Make it Double Calendar2 min

-

More Adjustments2 min

-

EXIT2 min

Diagonals

0/5Double Diagonals (Iron condor Alternative)

0/6Double Diagonals (Iron condor Alternative)

0/6Double Diagonals (Iron condor Alternative)

0/6Double Diagonals (Iron condor Alternative)

0/6Art of Butterfly

0/1Art of Butterfly

0/1Iron Butterfly

0/2Art of Butterfly

0/2All PUT Iron Butterfly

0/12-

All Put FLY - Setup and Entry2 min

-

All Put FLY - Setup and Entry2 min

-

All Put FLY - Adjustment2 min

-

All Put FLY - Adjustment2 min

-

All Put FLY - Downside Adjustment5 min

-

All Put FLY - Downside Adjustment5 min

-

All Put FLY - Upside Adjustment1 min

-

All Put FLY - Upside Adjustment1 min

-

Flat Iron Butterfly - Setup and Entry2 min

-

Flat Iron Butterfly - Setup and Entry2 min

-

Flat Iron Butterfly - Adjustments5 min

-

Flat Iron Butterfly - Adjustments5 min

Bullish Bearish & Time Bomb Butterfly

0/3Balanced and Unbalanced Butterfly

0/3Iron Butterfly

0/5Bullish Bearish & Time Bomb Butterfly

0/3Straddle Strangle & Back Ratio

0/3Iron Condor

0/4All PUT Iron Butterfly

0/12-

All Put FLY - Setup and Entry2 min

-

All Put FLY - Setup and Entry2 min

-

All Put FLY - Adjustment2 min

-

All Put FLY - Adjustment2 min

-

All Put FLY - Downside Adjustment5 min

-

All Put FLY - Downside Adjustment5 min

-

All Put FLY - Upside Adjustment1 min

-

All Put FLY - Upside Adjustment1 min

-

Flat Iron Butterfly - Setup and Entry2 min

-

Flat Iron Butterfly - Setup and Entry2 min

-

Flat Iron Butterfly - Adjustments5 min

-

Flat Iron Butterfly - Adjustments5 min

Balanced and Unbalanced Butterfly

0/3Iron Condor

0/4Bullish Bearish & Time Bomb Butterfly

0/5Iron Condor

0/4Balanced and Unbalanced Butterfly

0/5Straddle Strangle & Back Ratio

0/8

Text lesson

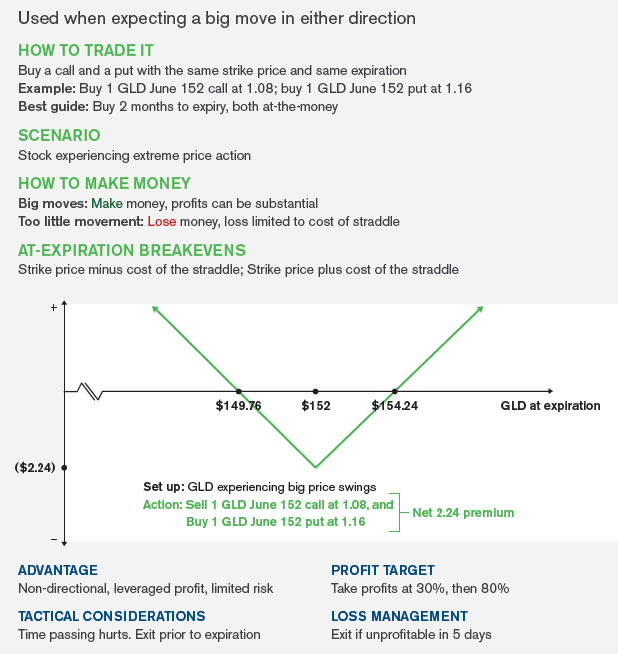

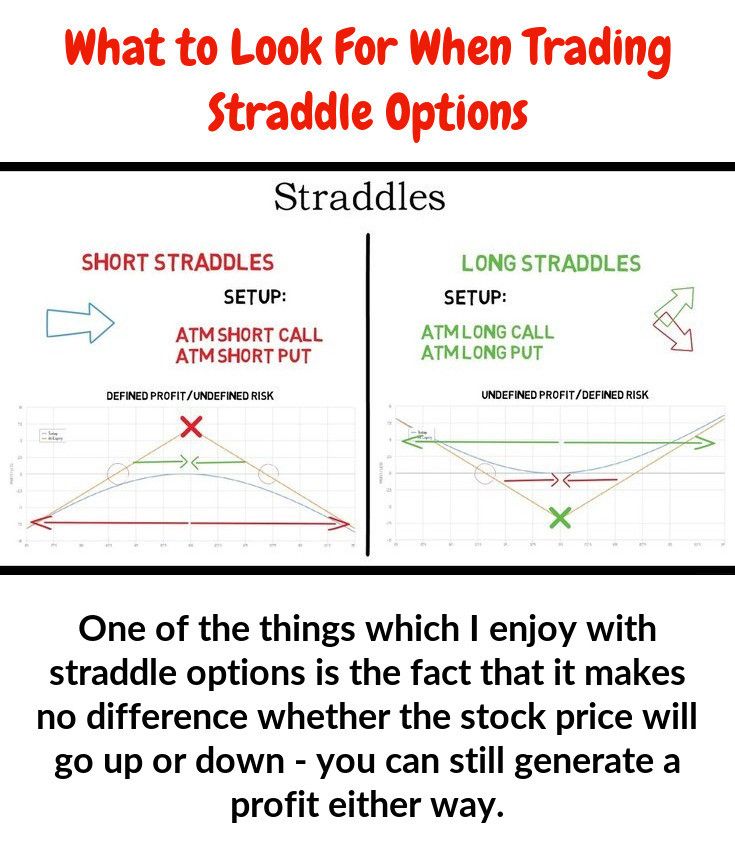

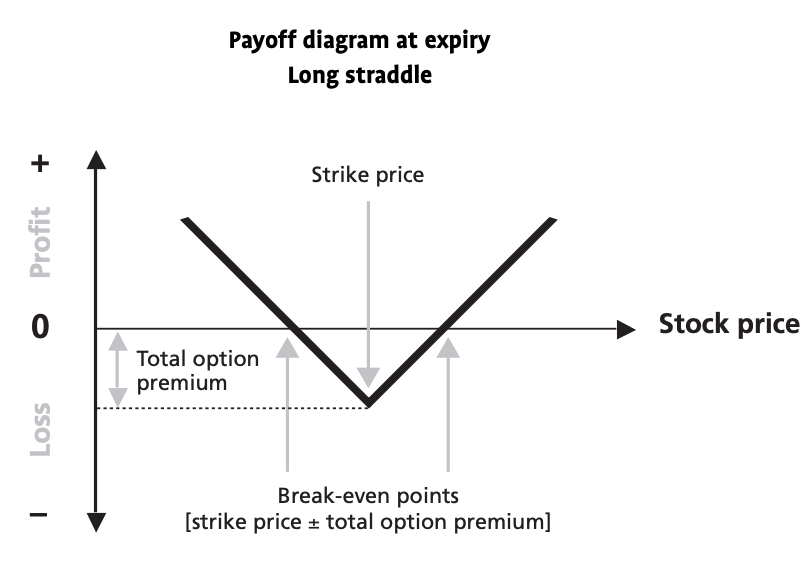

Straddle

A straddle is an options strategy involving the purchase of both a put and call option for the same expiration date and strike price on the same underlying. The strategy is profitable only when the stock either rises or falls from the strike price by more than the total premium paid.

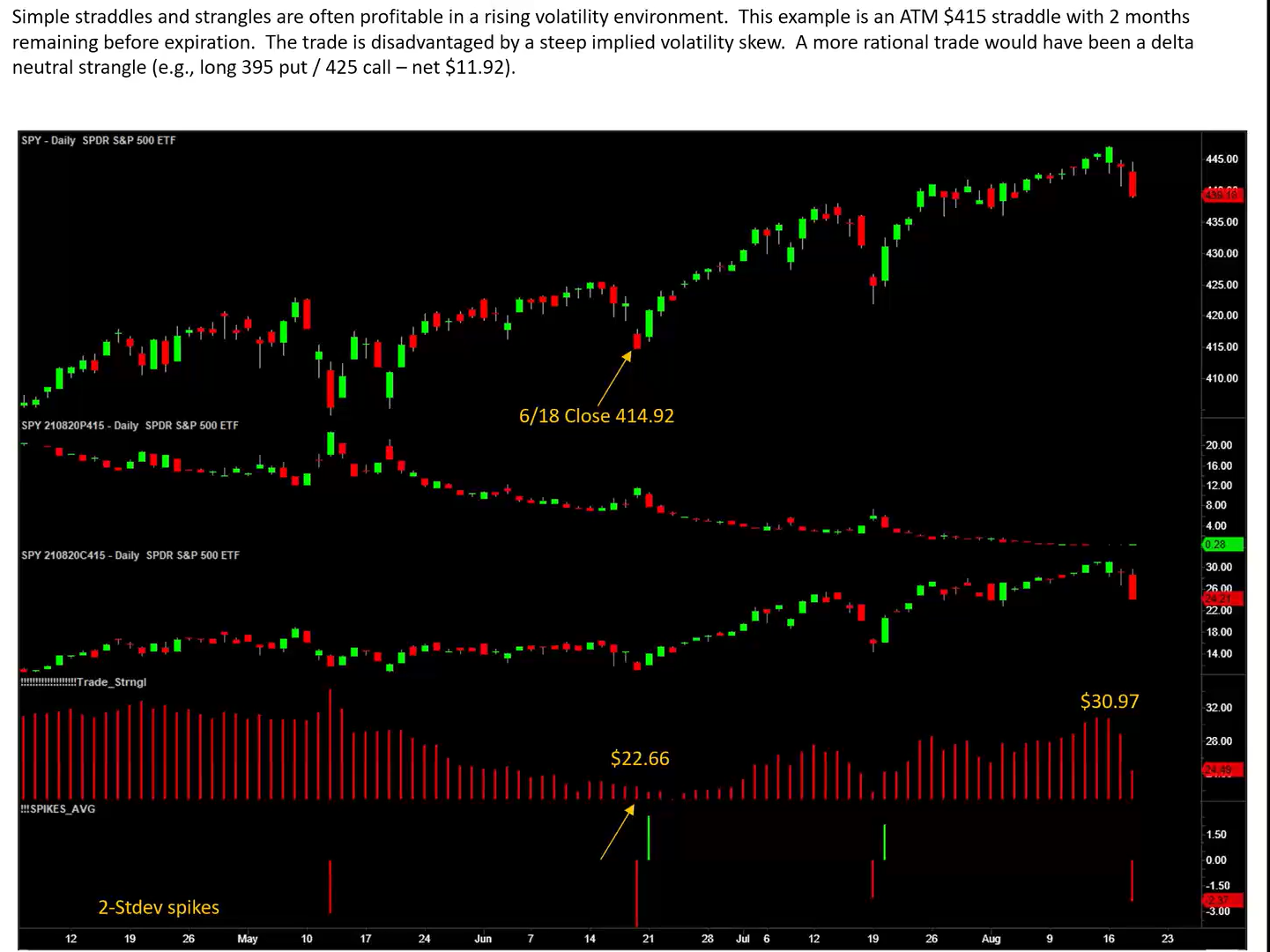

SPY straddle Example

– More better trade is SPY (strangle long 395 put / long 425 call )

Summary