Curriculum

Options - Advanced Concepts

Calendars

0/13-

Calendar Spreads1 min

-

Front Month vs Back Month Decay2 min

-

Best conditions for calendar spread2 minPreview

-

Trade Entry2 min

-

ATM calendar1 min

-

Calendar with Long Delta2 min

-

Split Strike Calendar in High vix5 minPreview

-

Execution2 min

-

Calendar Adjustments5 min

-

Lower Adjustment Point - Long PUT5 min

-

Upside Adjustment - Make it Double Calendar2 min

-

More Adjustments2 min

-

EXIT2 min

Calendars

0/13-

Calendar Spreads1 min

-

Front Month vs Back Month Decay2 min

-

Best conditions for calendar spread2 minPreview

-

Trade Entry2 min

-

ATM calendar1 min

-

Calendar with Long Delta2 min

-

Split Strike Calendar in High vix5 minPreview

-

Execution2 min

-

Calendar Adjustments5 min

-

Lower Adjustment Point - Long PUT5 min

-

Upside Adjustment - Make it Double Calendar2 min

-

More Adjustments2 min

-

EXIT2 min

Calendars

0/13-

Calendar Spreads1 min

-

Front Month vs Back Month Decay2 min

-

Best conditions for calendar spread2 minPreview

-

Trade Entry2 min

-

ATM calendar1 min

-

Calendar with Long Delta2 min

-

Split Strike Calendar in High vix5 minPreview

-

Execution2 min

-

Calendar Adjustments5 min

-

Lower Adjustment Point - Long PUT5 min

-

Upside Adjustment - Make it Double Calendar2 min

-

More Adjustments2 min

-

EXIT2 min

Calendars

0/13-

Calendar Spreads1 min

-

Front Month vs Back Month Decay2 min

-

Best conditions for calendar spread2 minPreview

-

Trade Entry2 min

-

ATM calendar1 min

-

Calendar with Long Delta2 min

-

Split Strike Calendar in High vix5 minPreview

-

Execution2 min

-

Calendar Adjustments5 min

-

Lower Adjustment Point - Long PUT5 min

-

Upside Adjustment - Make it Double Calendar2 min

-

More Adjustments2 min

-

EXIT2 min

Diagonals

0/5Double Diagonals (Iron condor Alternative)

0/6Double Diagonals (Iron condor Alternative)

0/6Double Diagonals (Iron condor Alternative)

0/6Double Diagonals (Iron condor Alternative)

0/6Art of Butterfly

0/1Art of Butterfly

0/1Iron Butterfly

0/2Art of Butterfly

0/2All PUT Iron Butterfly

0/12-

All Put FLY - Setup and Entry2 min

-

All Put FLY - Setup and Entry2 min

-

All Put FLY - Adjustment2 min

-

All Put FLY - Adjustment2 min

-

All Put FLY - Downside Adjustment5 min

-

All Put FLY - Downside Adjustment5 min

-

All Put FLY - Upside Adjustment1 min

-

All Put FLY - Upside Adjustment1 min

-

Flat Iron Butterfly - Setup and Entry2 min

-

Flat Iron Butterfly - Setup and Entry2 min

-

Flat Iron Butterfly - Adjustments5 min

-

Flat Iron Butterfly - Adjustments5 min

Bullish Bearish & Time Bomb Butterfly

0/3Balanced and Unbalanced Butterfly

0/3Iron Butterfly

0/5Bullish Bearish & Time Bomb Butterfly

0/3Straddle Strangle & Back Ratio

0/3Iron Condor

0/4All PUT Iron Butterfly

0/12-

All Put FLY - Setup and Entry2 min

-

All Put FLY - Setup and Entry2 min

-

All Put FLY - Adjustment2 min

-

All Put FLY - Adjustment2 min

-

All Put FLY - Downside Adjustment5 min

-

All Put FLY - Downside Adjustment5 min

-

All Put FLY - Upside Adjustment1 min

-

All Put FLY - Upside Adjustment1 min

-

Flat Iron Butterfly - Setup and Entry2 min

-

Flat Iron Butterfly - Setup and Entry2 min

-

Flat Iron Butterfly - Adjustments5 min

-

Flat Iron Butterfly - Adjustments5 min

Balanced and Unbalanced Butterfly

0/3Iron Condor

0/4Bullish Bearish & Time Bomb Butterfly

0/5Iron Condor

0/4Balanced and Unbalanced Butterfly

0/5Straddle Strangle & Back Ratio

0/8Strangle

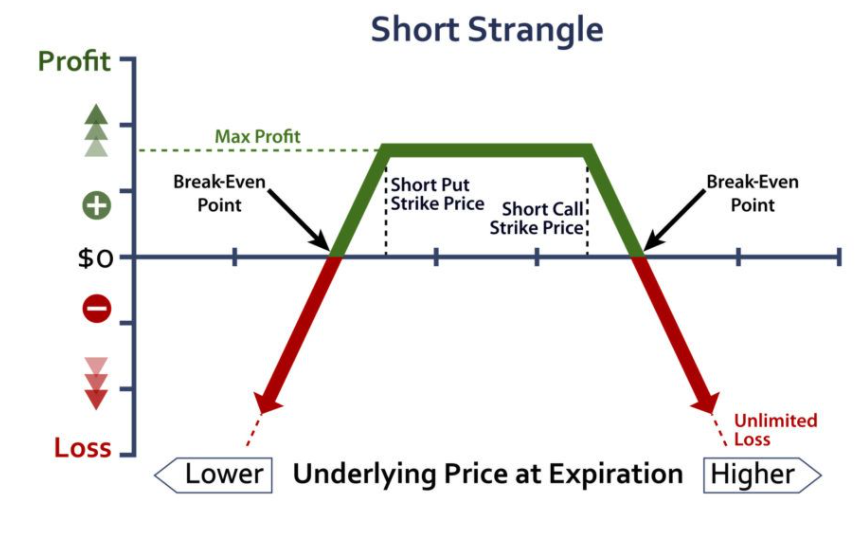

Short Strangle is an option selling strategy which involves selling an OTM call option and an OTM put option. It benefits the most if the underlying ends within a range by expiry. Maximum profit is the amount of premium collected by selling the options. The loss on this strategy is unlimited.

A strangle is a neutral strategy that takes advantage of premium decay on both sides of the market by selling a call and put.

• Since a short call is a bearish play and a short put is a bullish play, the two options together hedge each other off thereby creating a range in between to be profitable.

• Only one side can be ITM at a time, so if the call side is losing money then the put side is making money. When you sell a strangle, you collect premium from selling both sides. If the stock stays between each short strike, the extrinsic value of both options continually erodes and you make money.

• Selling both sides of a stock using options also increases the amount of premium you collect.

• Furthermore, strangles give you the ability to manage the trade much more easily. If one side of my strangle gets breached, then I immediately roll the other side up or down for an additional credit to improve my breakeven price. But if everything goes right, I close the trade at 50% max profit or when the expiration date gets within 21 days.

Here is an example of a strangle in Costco

• In late August 2020, Costco shot up after announcing the opening of their first store in China.

• After a few days of consolidation, I noticed the IV Rank of COST climbed above 50% so I put on the 270/315 strangle in Oct expiry for a $5.06 credit.

• By selling the 270 puts and 315 calls for a $5.06 in premium, I gave myself a profit range of $264.94 to $320.06 for COST’s price to stay within by the end of expiration. After a few weeks’ time on September 24th, I closed the strangle for 50% max profit or $2.53 in premium decay.