by Mahesh Kalbhor | Feb 13, 2022 | Weekly Update

BEAR MARKET RULES:

1. Overbought conditions in a bear market — expect a new down leg.

2. Oversold conditions in a bear market — “thin ice”, no solid foundation for price bounces.

3. Buying into a bear market is dangerous regardless of the bullishness of the chart.

4. Expect bearish conclusions to bullish chart patterns.

5. Manage long-term positions as if they were short-term positions.

The charts on Wednesday 2/9/22 did look promisingly bullish. After Thursday 2/10 morning’s big drop from the rising trend channel likely due to the CPI report showing accelerating inflation, price was beginning to make its way back to positive territory. Then it fell apart. The breakdown was exacerbated by St. Louis Fed President Bullard suggesting a full percentage point rate hike by July. So it was a double whammy for the market.

After the market closed on Thursday, we identified an downside initiation climax. A downside initiation climax tells us to expect more decline. We were churning this morning and losing ground. Then we got the news that the White House was expecting Russia to invade Ukraine before the finish of the Olympics. The market sold off in earnest.

A climax is a one-day event when market action generates very high readings in (primarily) breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. Climaxes indicate either initiation of a price move or exhaustion of the current trend.

Conclusion: When the market is correcting or in a bear market, we need to remember that bullish expectations should be tempered. Oversold conditions that you we see often in bear markets become “thin ice”, a poor foundation for an extended rally. That is what I forgot on Wednesday. Lesson learned.

by Mahesh Kalbhor | Feb 12, 2022 | Weekly Update

A turbulent start of the year for U.S. stocks has entered a new phase in recent days, with investors weighing good news about corporate earnings and the labor market against the stubborn challenges of high inflation, rising bond yields, and geopolitical uncertainty ( Ukraine Invasion Threat by Russia)

A driving force behind many market swings remains the increase in U.S. government bond yields, fueled by escalating expectations for how high the Federal Reserve will raise short-term interest rates this year.

Yields, which rise when bond prices fall, are a bedrock gauge for investors because they help dictate borrowing costs on everything from mortgages to corporate debt. They are also a major component of financial models used to value stocks and other assets. All else being equal, the ability to earn higher returns on risk-free bonds makes the future earnings of businesses less valuable, dragging down share prices.

For much of January, analysts widely agreed that this simple relationship was paramount for stocks. The yield on the benchmark 10-year U.S. Treasury note surged from 1.496% at the end of last year to 1.866% on Jan. 18. Stocks fell, led by technology (FB, AAPL, AMZN, GOOG, TSLA) companies, many of which are especially sensitive to rising rates because their value stems largely from their potential earnings down the road.

Since then, the relationship between bonds and stocks has grown more nuanced. Stocks were able to rebound over a period when bond yields stabilized, but they still rose broadly even when yields climbed sharply on Feb. 4, following a better-than-expected jobs report. Yet stocks fell Thursday after consumer-price index (CPI) data showed inflation reached another four-decade high last month, and equities extended declines Friday in the midst of growing worries about a potential Russian invasion of Ukraine.

By the end of Friday 2/11, the S&P 500 had logged its fourth weekly decline out of the past six weeks, falling 1.8%. The 10-year yield settled at 1.951%, down from 2.028% on Thursday 2/10, setting up a week in which investors will track the latest developments on the Russia-Ukraine situation, earnings from the likes of ZoomInfo Technologies Inc. and Airbnb Inc., and clues from Fed officials about their plans for the March policy meeting.

In recent weeks, several factors have helped stocks. One has been a solid round of fourth-quarter corporate earnings. The strong jobs data further bolstered the economic outlook, while January’s stock slump made prices start to look more attractive to some investors. Few, however, found silver linings in Thursday’s (2/10/22) inflation data, a reminder of the hard-to-predict economic trends that could keep investors on edge this year. Reports that Russia is on the verge of invading Ukraine added another blow, sending both stocks and bond yields sliding as investors rushed into safer assets such as Bonds (TLT) and TLT jumped high on Friday 2/11.

Typically, the early years of rate-increase campaigns have worked out for investors. The past six times the central bank has raised rates, stocks have generated positive returns each time in the first year and five out of six times in the second year, according to a Bank of America report from November. The one exception came when rate increases possibly helped burst the tech bubble around the turn of the millennium.

Fed rate-increase cycle could be more dangerous than some others because stocks have entered at elevated valuations. Companies in the S&P 500 traded late last year at nearly 39 times their cyclically adjusted earnings, higher than at any other point apart from the tech bubble.

Valuations, though, aren’t quite as high by other measures and are now lower after January’s selloff. S&P 500 companies traded late last month at as low as 19.3 times projected earnings over the next 12 months, according to FactSet, falling below 20 for the first time since April 2020. That was down from a 21.5 multiple entering the year, though still above the five-year average of 18.9.

Conclusion

“We know that markets don’t like uncertainty, but we think this cycle will play out like the others where the economy and corporate profits are strong enough that we’ll be higher at the end of the year than we are now,” . “The market will become comfortable with the path of rate hikes, probably within the next several months.”

Long term outlook remains largely bullish on the U.S. stock market. In particular, there are opportunities to buy software companies and chip makers—eg. companies which have strong fundamentals and attractive valuations after the recent selloff in growth stocks.

The upside is limited because…growth is going to slow and the Fed is going to get more aggressive.”

by Mahesh Kalbhor | Feb 10, 2022 | Weekly Update

Here are technical analysis 🧐 charts before we see CPI reports tomorrow

SPY 🕵️♀️ CHART

SMH – Semiconductors ETF CHART

IWM CHART

QQQ CHART

by Mahesh Kalbhor | Feb 1, 2022 | Weekly Update

Even after a rough January for Wall Street, it might take the U.S. economy slipping into a recession before the S&P 500 index risks entering a bear market, according to Oxford Economics.

“Equities are flirting with correction territory. We think this drawdown may have a bit further to go as investors grapple with a more hawkish Fed and slowing earnings momentum,” wrote David Grosvenor, director of macro strategy at the economic research and analytics firm, in a note Monday.

However, we do not think it is the beginnings of a new bear market and we remain modestly overweight on global equities over our tactical horizon, albeit with a relative underweight on the growth-heavy U.S. market.”

The rate- sensitive Nasdaq Composite Index COMP already entered correction territory in mid-January, after closing at least 10% below its November record finish, while the small-capitalization Russell 2000 index RUT last week slipped into a bear market, defined as a fall of at least 20% from a recent peak.

The S&P 500 SPX also spent several sessions in late January trading below its correction level of 4,316.905 intraday, but avoided closing below that key mark. The rally for stocks on Monday, with the S&P 500 powering 1.9% higher, put even further distance between it and correction terrain.

What’s more, when the economy isn’t in a recession, historical corrections for the S&P 500 have meant average declines of about 15.4% (see chart), with “very few resulting in bear markets,” according to Grosvenor.

Given that a recession appears unlikely at this time, with global growth forecast to remain above trend this year, we see this lower average as the more useful guide to the potential scale of the decline.”

Corporate balance sheets also appear to be in “a better condition than before the pandemic,” according to Grosvenor, who also noted big companies hold large cash buffers and have pushed out their debt maturities in the past two years of ultra low rates. All that makes defaults and widespread corporate distress less likely without “fairly aggressive” tightening of financial conditions or a “meaningful downturn.”

by Mahesh Kalbhor | Jan 30, 2022 | Weekly Update

The FED , the Federal Reserve, which looks ready to compound one

mistake with another. First calling inflation as transitory all last year in 2021 which helped bulls to pump the market into super bubble. Second mistake is to hike the rates too aggressively and put the economy into recession.

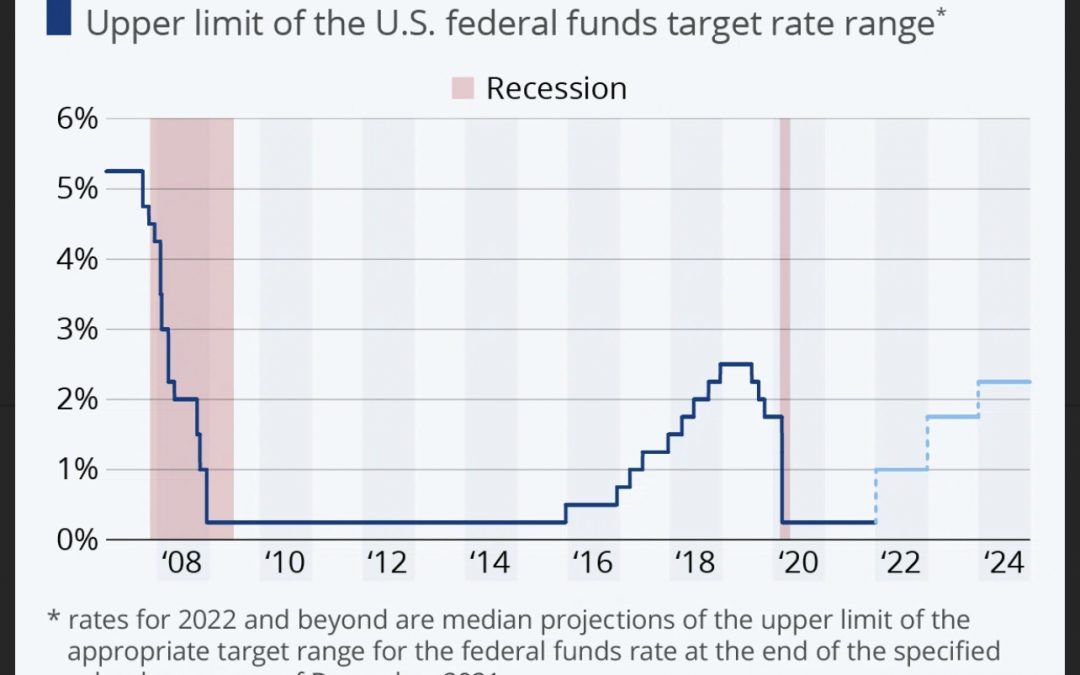

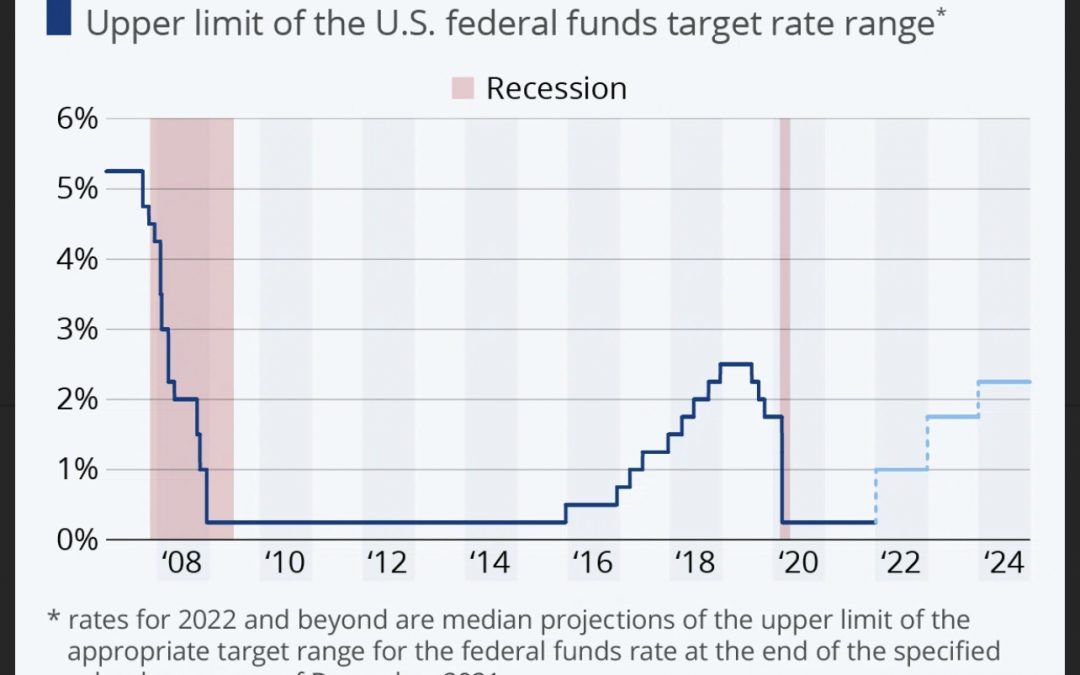

The Fed is behind the curve on inflation; the core personal-consumption-expenditure deflator rose 4.9% in December on an annualized basis, more than double the 2% inflation target. Now the Fed is ready to raise interest rates, probably in March, after assuming rising prices would be transitory.

The central bank’s statement on Wednesday Jan 26th 2011 contained few surprises, but then Fed Chairman Jerome Powell started talking. At first, he offered a fairly balanced outlook of the risks, with inflation on one side and the threat to growth from Omicron on the other, with the risks tilting a touch more toward the former than the latter.

But the more he spoke, the more hawkish he sounded. He didn’t dismiss the possibility of a half-point rate increase and suggested that the Fed could raise rates far more quickly than the four increases the market had priced in. By the end of the day, the Dow Jones Industrial Average had turned a 518-point gain into a 130-point drop, and investors were pricing in more than four rate hikes.

By Friday Jan 27th 2021 however, the overall averages conveyed little of that volatility. The Dow finished up 460.10 points, or 1.3%. The Nasdaq Composite ended the week little changed as blockbuster earnings from Apple (ticker: AAPL) and Microsoft (MSFT) helped it make back what had been a 4.9% loss. Only the Russell 2000, which officially entered a bear 🐻 market on Thursday, finished the week lower, by 1%.

Massive reversals were the norm, and the market went from simply oversold to “super oversold,” “When there’s this kind of selling intensity, there’s usually another short term drop and a quick dead ☠️ cat 🐈⬛ bounce before it falls apart into pieces.

But even when the market bounces-and it will bounce-investors have to know that the clock is counting down to recession and the end of the bull market. The clock, in this case, is the yield curve, and an inverted one is the one truly reliable recession signal. An inversion occurs when longer- term rates, which are typically higher than short-term ones, sink below their short-end counterparts. That’s not just a signal that a recession is coming-it also helps create the conditions for one by making lending unprofitable for banks, which borrow short and lend long.

Ultimately, the lack of credit causes a recession, though it usually takes months to occur.

The yield curve is flattening quickly. On Friday, the two-year Treasury yield closed at 1.17%, while the 10-year closed at 1.779%, putting the gap between them at 0.61 of a percentage point. On Dec. 31, that gap was 1.069 points. Since 1955, the yield curve has flattened about 0.8 of a point a year during the first year of a tightening cycle, which would mean the curve would invert sometime in the first half of 2023.

Recessions usually follow in eight to 19 months, which would put the next one in the middle of 2024. If the current market follows the historical path, the current upheaval, though painful, should simply mark a tantrum in risk markets that will pass.

But much will depend on how serious Powell is about raising rates to tackle inflation and the path of economic growth. Most analysts expects the Fed to lift rates aggressively, only to find that the economy is growing at a much slower pace than it thinks. He isn’t wrong about the economy, which looks set to slow during the first quarter of 2022, thanks, at least in part, to the Omicron variant of Covid-19.

The Fed is starting its rate increases too late. And the Fed will tighten the economy right into a recession.

“Inflation will be killed by the Fed,” “Given the nature of this inflation, which is far more related to supply constraints than booming demand, it is going to create a renewed recession.” Again, the volatility we’re seeing now is just the beginning of a bear market.

inflation is real, and that the Fed won’t have the guts to do what it will take to defeat it-tighten the economy into recession. “Recession [is] the only way to successfully fight inflation,” “They don’t have the backbone to do that.”

Because as painful the current drop has been, It’s next one that will hurt 😞

by Mahesh Kalbhor | Jan 28, 2022 | Weekly Update

What Are “Interest Rates” Anyway?

The Fed announced yesterday (Wed Jan 26th 2022 ) during press conference that interest rates are going up. And now the stock market’s going down… but why?? What the heck does the Fed have to do with interest rates, anyway? 🤔

For the unacquainted who’ve seen us talking about the importance of the Fed for a year, our obsession with interest rates might seem like infatuation. 😍 But that’s because interest rates affect many aspects of life in a country, its economy, and its markets. Let’s examine why:

* The Federal Reserve controls the federal funds rate (this ‘interest rate’ JPow talks about), which is the target interest rate at which commercial banks can lend their reserves to each other. A bank’s reserves describe the cash that banks have to keep in actual vaults to make sure they have enough liquid money to satisfy a large withdrawal. The federal funds rate is important because it affects unemployment, economic growth, and inflation in the U.S. 🚨

* The federal funds rate affects other interest rates that you may be familiar with, such as interest rates on home or auto loans. 🚗 🏡Why does this relationship exist? Well, because the interest rate at which you have to pay back your car loan depends on the bank’s individual rate for you (this is known as the prime lending rate), and your individual rate is directly related to the federal funds rate.

* You probably heard yesterday that the Fed is going to ‘reduce its balance sheet’ and ‘raise rates.’ When the federal funds rate is low, it encourages people to invest or take out loans (because you have less interest to pay back.) That’s why the Fed lowered rates during the pandemic in an effort to incentivize people to participate in the economy in spite of lockdowns. The Fed also started buying bonds and other securities — ‘increasing the size of its balance sheet’ — in a process called quantitative easing to help lower interest rates.

* Although lowering rates and increasing asset purchases was an appropriate short-term monetary response to the pandemic-era economy, low rates and printing lots of money causes inflation in the long run, which is where we are now.

* So if raising rates helps combat inflation, why is the stock market reacting negatively? Because higher interest rates raise borrowing costs, disincentivize hiring, increase credit card rates, and generally slow down the economy (at least, temporarily.) And when the economy slows down, bonds become more appealing investments because they’re less risky — so investors are selling or switching to bonds to avoid losing money. 💡

At the end of the day, the Fed is reacting to inflation in a way that’s historically appropriate. The market just isn’t happy because, in the words of JPMorgan analyst David Stubbs, “What the market doesn’t like, is rapid changes in the monetary landscape.” 🤷