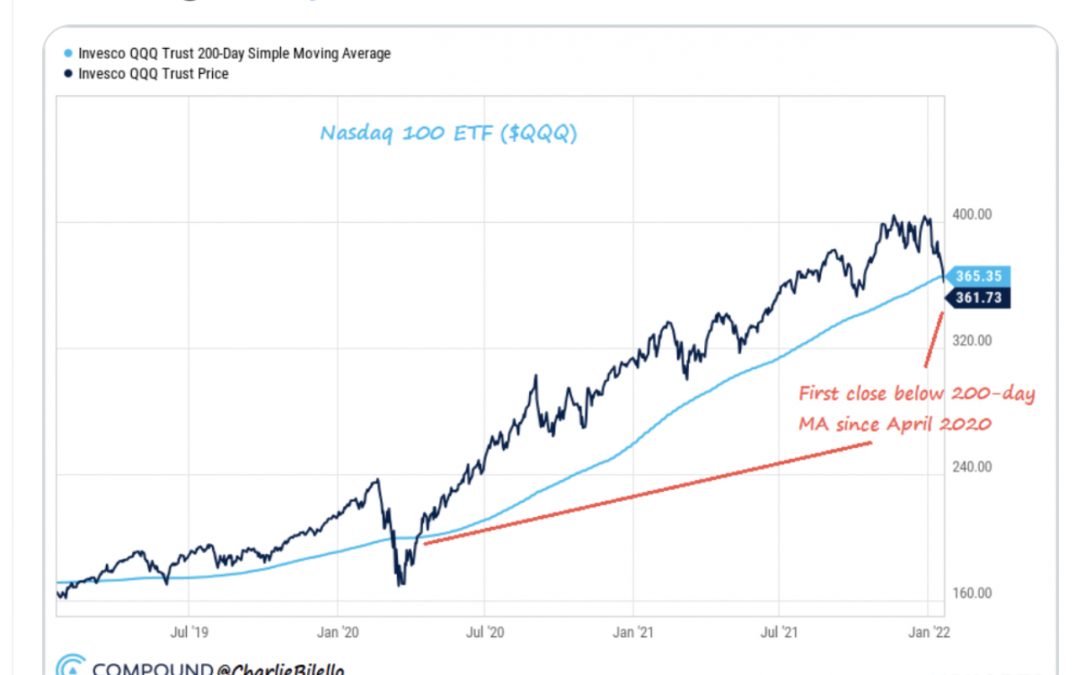

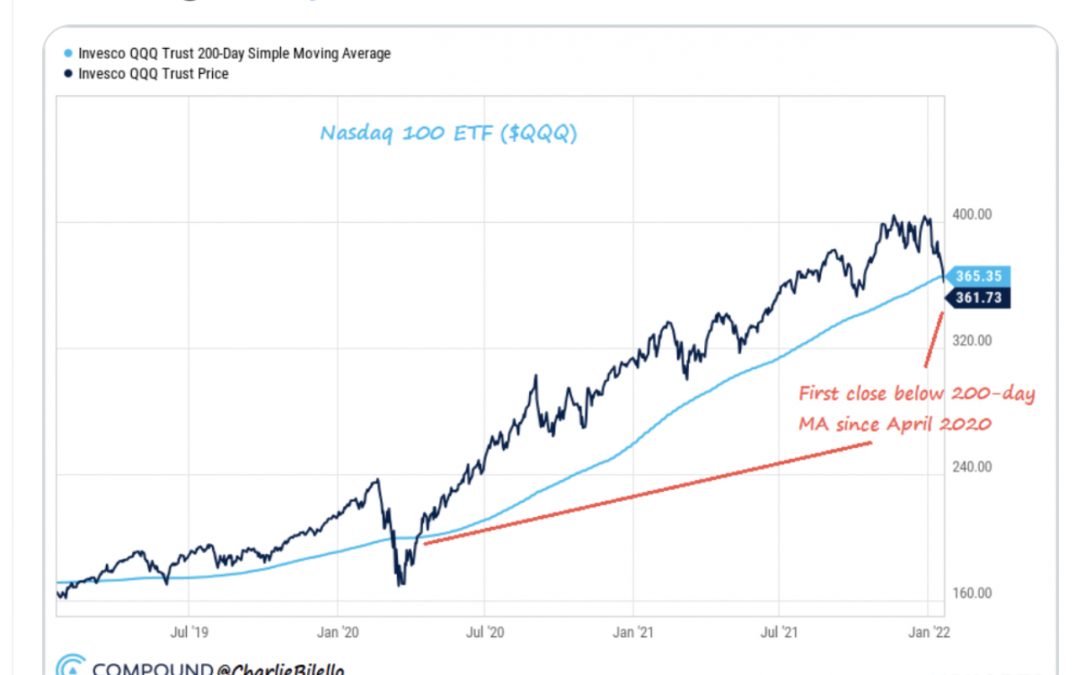

Tech bubble $QQQ

The Nasdaq 100 ETF closed below its 200-day moving average today for the first time since April 2020, ending one of the longest runs in history (450 tradingdays). $QQQ

The Nasdaq 100 ETF closed below its 200-day moving average today for the first time since April 2020, ending one of the longest runs in history (450 tradingdays). $QQQ

Stock market 📈 survival tips –

1. Buy what you know – Never buy a stock whose intrinsic value you can’t estimate reliably – and always get a big discount when you buy.

2. Allocate to value: Wait to make major investments when other investors are panicking and truly safe, outstanding opportunities abound.

3. Use good money-management techniques. Follow position-sizing guidelines and trailing stop losses. Never own more positions than you can carefully follow. Always keep a large cash reserve.

4. Do everything you can to avoid fees and taxes. Simply avoiding a 2% annual fee against your asset base (by not using money managers) is the No. 1 surest way to outperform your peers.

CPI Index

The Labor Department reported December’s consumer price index 1/12/22— and it wasn’t pretty. Inflation was up 7% YoY in December. The last time the CPI rose that quickly was 40 years ago, in 1982. The consumer-price-index (CPI) measures how much Americans pay for goods and services. In November, the CPI was up 6.8% YoY, so the December report represents a 0.2% month-over-month increase in inflation. Similarly, the core price index (basically the CPI, just excluding food and energy categories) saw a 5.5% YoY increase in December.

Read more here : https://www.wsj.com/articles/us-inflation-consumer-price-index-december-2021-11641940760?mod=hp_lead_pos1

Inflation

In 1980, inflation reached a peak of 14.8% under Jimmy Carter’s presidency. Like today, the Fed Chair in the early 80s, Paul Volcker, made it his mission to squash inflation. Volcker raised interest rates to 19% in 1981, prompting a recession — however, in 1982, both interest rates and inflation began to fall dramatically. Volcker is still remembered as somewhat of a legend who killed double-digit inflation.

FED – Tapering and Balance sheet

The Fed’s already tapering at breakneck speed, aiming to be done by March. Remember, though: tapering just means reducing the speed at which they add assets to their balance sheet. So the balance sheet still grows, but slower and slower until it grinds to a halt.

What the Fed hasn’t discussed much yet is shrinking that balance sheet.

Since the beginning of the pandemic, the Fed has added more than $4 trillion in Treasury bonds and mortgage-backed securities to its holdings… More than doubling their balance sheet from $4.1 trillion to over $8.7 trillion. Thanks to print money technique by FED to boost economy. And they’re still buying for a couple more months, albeit more slowly. In December, the Fed implied they were just starting to talk about trimming down the balance sheet. Trimming the balance sheet is linked to interest rates — selling bonds takes money out of the economy and pushes bond prices down, raising rates. We know the Fed promised 3 this year. They never explicitly mentioned a 4th, but many analysts expect a more aggressive approach at this point.

January FED meeting (1/25 and 1/26) is in 2 weeks. We’ll know more by the end of this month.

The Fed – Meeting calendars and information (federalreserve.gov)

Trade safe ..!!

Symbol: MSFT

Direction: Bullish ; Strategy: Bull Put Credit spread

Strike Selection: Buy 280 / Sell 290 Put in Feb-18’22 ( Premium received $2.4 per contract )

Probability of Profit: 80% (89% P50)

Comments: IV Rank of 64% and -10% from its top is an attractive short premium setup.

Symbol: MSFT

Direction: Bullish ; Strategy: Bull Call Debit Spread

Strike Selection: March 18 expiry, 325 / 340 Bull Call spread

Probability of Profit: 50% ; Adjustment – Double down if the trade goes against you and then adjust with either diagonal or calendar spread ; Comments: As QQQ almost dropped 6% from it high now its a good time to bottom-fish some high quality names like MSFT GOOGL AMZN ..

Symbol: XLF

Direction: Bullish ; Strategy: Long Call

Strike Selection: Buy +1 XLF 42 Call in Feb-18’22

Probability of Profit: 28%

Comments: UOA – unusual option activity of massive buyer of 42 calls. Rising 10 year yield interest rates and bonds falling is good for banks with fed tapering in 2022 . Adjustment – Double down if the trade goes against you and then adjust with either diagonal or calendar spread

1/2/21 Update – MSFT Profit posted

Taper Tantrum was in full force yesterday after the Fed Minutes came out at 2 PM (1/5/2021) with the Markets behaving like a child, even though the news about raising interest rates was already signaled on Dec 15th 2021 after the last Fed meeting.

At this point it is a bit overdone.

Bitcoin also tanked after the Federal Reserve released twinkles of its December meeting, with policy makers indicating growing apprehension over affectation and the eventuality for interest rates to start rising as soon as this March.

Bitcoin was down more than 4% , soon after the Fed made the meeting minutes public. Fed officers indicated that inflation and tight labor conditions could warrant an interest- rate increase sooner or at a faster pace than anticipated. The minutes also indicated that the Fed may start to shear back its $8.8 trillion balance distance “ fairly soon” after raising its standard rate.

The selloff in Bitcoin coincided with a sharp downturn in equities, with tech taking it particularly hard. The selloff in Bitcoin is another sign that it’s acting more like a tech stock than an hedge such as digital gold.

If Bitcoin and other cryptos aim to be viewed as true digital assets then will need to start performing that way. So far, the markets are treating them like high- growth bets.

Trade Safe ..!!